Service management, together with sourcing, is responsible for developing and managing successful supplier relationships by adopting a clearly defined and structured approach to supplier collaboration.

Service managers maintain supplier relationships through regular meetings that address not only current services development plans, performance and costs, but also opportunities to expand the relationship to different or new services, driven by the company’s ambition to create innovative digital services.

Supplier relationship and performance management aims to build a healthy supplier ecosystem able to answer the immediate needs from a company. A good supplier ecosystem will also be able to support the company’s future business strategy by offering aligned innovative services or proposing proactive innovation or optimisation opportunities to the company.

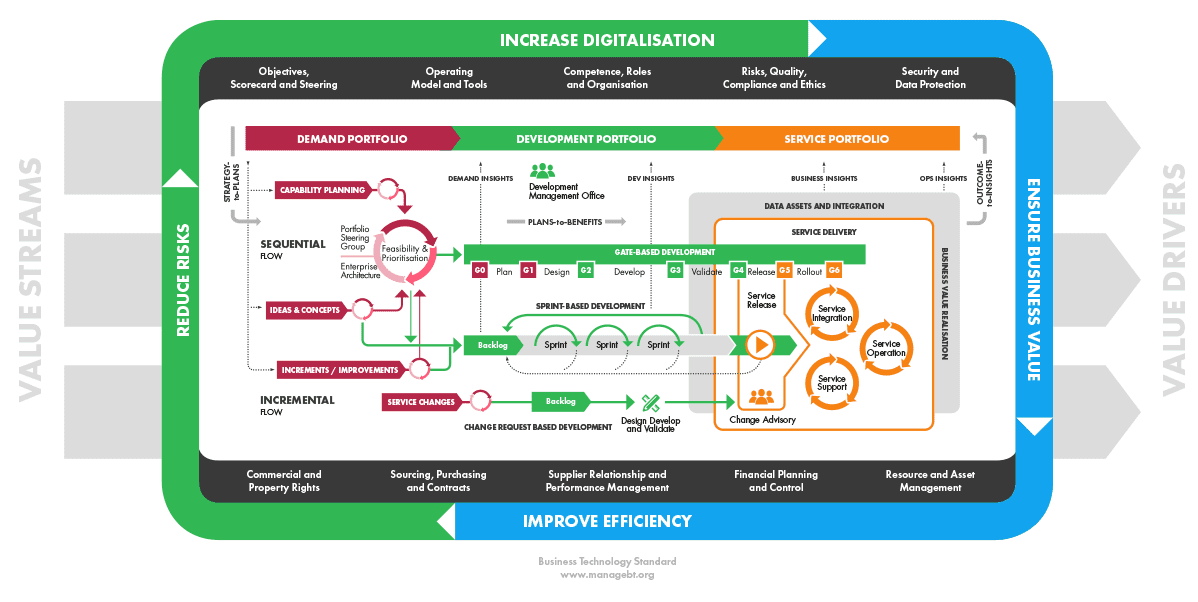

Figure 4.3.1 Supplier relationship and performance management overview

Supplier relationship and performance management capability typically includes the following set of activities:

Figure 4.3.2 From traditional pyramid structure to modern diamond model

Supplier relationship management aims to maintain a good relationship between the company and its suppliers. The objective is to build an ecosystem of collaborative partners, and work closely with them to build future service plans that benefit both the company and the suppliers.

A good approach to maintaining relationships with suppliers and ensuring that employees interact with relevant stakeholders from the supplier’s side, is to organise the relationship management in three layers:

The focus is typically on strategic and tactical levels whereas the time used for operative management can be reduced by using IT Service Management (ITSM) systems with real-time service information.

The goal in supplier relationship is to build collaborative relationships with the suppliers and maintain a list of the company’s technology related suppliers and categorise them.

Categorisation helps the company to:

Categorisation can have multiple dimensions, amongst which the most commons are:

Based on above classification, the company decides whether the nature of a supplier relationship is critical, strategic, tactical or operative. Additionally, based on the individual supplier’s impact and value to the business, an adequate level of collaboration and performance management should be determined for each supplier.

The Business Technology Standard advocates a slightly different approach to classification by providing a perspective to use technology services to create business value. It distinguishes primary vendors that are key value drivers in digital, technology or business transformation, complementary vendors that provide key business-related solutions and services and utility vendors that empowers the company with commodity services (e.g. network or workstations).

Performance management has an essential role in setting targets and controlling the supplier performance. It creates a quantitative scale for measuring and verifying contractually agreed and targeted performance of the suppliers.

Performance management starts before any supplier relationship, as business performance targets must be decided before a service is implemented, or a solution purchased. Performance management then becomes an essential component of the supplier relationship, from the contracting phase until the purchased service’s operational delivery.

Figure 4.3.3 Performance management steps

The performance levels in operations are measured by determining accurate and unambiguous Service Level Agreements (SLAs). Measurement needs are established with the business considering the business continuity requirements and the corresponding cost impacts.

It is important to carefully consider target metrics because they will steer the suppliers’ performance in practice, in the spirit of: “You will get what you measure”. Well-defined metrics can form the measurable ground for penalties in the contract.

In many cases, vendors commit on key performance indicators (KPIs) which are more meaningful for the business and often requires co-operation between service providers, such as end-to-end software availability which is dependent on software, infrastructure and network.

Additionally, service managers, together with sourcing, should keep track on available services, quality standards and service pricing on the marketplace to enable comparison and fair benchmarking of sourced services. Furthermore, it is justified in outsourcing contracts to reserve rights to carry out audit of suppliers’ service processes to control their quality and performance.

Category management and performance reviews focus on viewing vendors from the inside-out. An outside-in perspective is needed to follow the technology trends in the marketplace. This activity can take place as dedicated initiatives on specific technologies or through continuous discussion with technology and services providers in order to better understand their offering.

The key objective is to support service development activities by promoting new technology opportunities, and by ensuring that there are no contractual issues prohibiting the development. This activity is also the demand discipline’s responsibility area.

Another way to ensure the sourced service follow the market trends is to compare current suppliers’ operational performance and cost in relation to their competitors (e.g. benchmark) to evaluate if there is need to review the contracts, to help to decide on a contract renewal or termination.

The contract lifecycle management is a proactive process that can lead to significant cost savings and service quality improvements.

Contract lifecycle management objectives are to:

It is a good practice to have named contract owners for contracts that have large service coverage and the ownership is not obvious. The contract owner works closely with financial management, service managers and sourcing.